1. Learn what goes into a credit score.

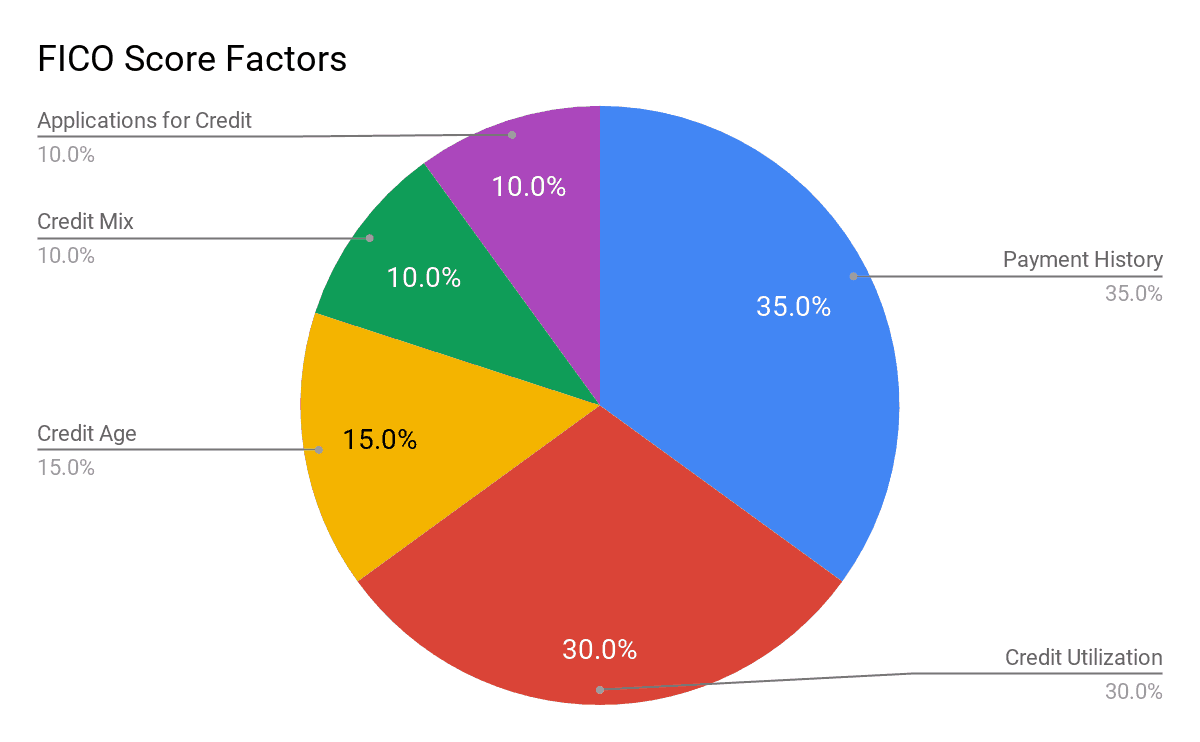

FICO scores take a few things into account: payment history, credit utilization, credit age, a mix of accounts, and recent applications for credit. As you can see in the chart, these factors aren’t exactly weighted evenly.

2. Get a copy of your credit report.

Under federal law, you can get one free credit report per year from each of the main credit bureaus: Experian, TransUnion, and Equifax. This is important because mistakes happen!

According to a study by the Federal Trade Commission, one in five people has found a mistake on one of their credit reports. Only one in ten consumers reported mistakes that actually affected their credit scores, but those are still odds that would make anyone want to double-check something so important. Common errors include simple ones such as closed accounts listed as open or accounts incorrectly listed as late or delinquent. Identity theft and credit card fraud can also lead to inaccurate information, so stay vigilant about suspicious activity on any of your accounts. The main credit bureaus may also use a scoring system called Vantage, which has slightly different ranges. While this may not be the exact same as your FICO score, a free credit report from one of them can still let you know roughly how your credit score is faring.

3. Pay your bills on time.

As you saw earlier, payment history accounts for 35 percent of your FICO score. So, make a spreadsheet with payment dates, set reminders for minimums due, and try to pay more than the minimum due if you can. If you’re opening a new credit card to help with paying off your debt, make on-time payments from the start. Never good with a deadline? Look into grace periods to see if you can avoid being penalized when payday comes a few days after your billing date.

4. Use less than 30 percent of your credit limit.

Sometimes referred to as credit utilization, this portion makes up 30 percent of your FICO score. The credit utilization ratio is basically the amount of credit that has been extended to you versus how much of that credit you’re using. For example, if your credit limit is $10,000 and you’re using $4,000, then you’re using 40 percent of your credit and your FICO score could be negatively impacted. If you must carry a high balance on your credit cards, see if your provider will raise your credit limit so that the same balance will utilize a lower percentage of your credit. If you don’t have a great payment history, however, this may not be an option for you.

5. Keep paid-off cards open.

Congratulations on paying off a credit card! But don’t close that card just yet. A fully paid-off card represents available credit that you aren’t using, helping your overall credit utilization ratio. In addition, a long history with that card shows you can make timely and consistent payments, demonstrating a favorable payment history. This will help you more than opening up a new card.

6. Pay down and manage debt.

Make a plan and stick to it. According to the Northwestern Mutual 2018 Planning and Progress Study, the average personal debt (excluding mortgages) was $38,000, and 2 in 10 people designated 50 percent or more of their income toward paying off their debt. While it can seem daunting to manage debt, it is doable. There are several debt management strategies you can try. A “debt snowball” strategy may show you results sooner and help motivate you, or a “debt avalanche” strategy may save you the most money in the long run. For raising credit scores, however, your best bet may be to pay off your debts in order of credit utilization.

For example, if you have a $1,000 balance on a card with a $3,000 credit limit and a $1,000 balance on a card with a $3,0000 credit limit, you would prioritize paying back the first card because it’s utilizing 50 percent of the credit extended to you on that card. This strategy might cost you more money in interest but lead to a healthier credit score if you can afford it.

7. Think about consolidating your debt.

There are several debt consolidation credit cards or loans out there for you to choose from. If you can find one with an interest rate better than what you’re already paying across your collective debts, it could mean paying off your loans a little sooner.

Keep in mind that credit cards often carry higher interest rates than personal loans. Also, a mix of credit cards and installment loans shows you can handle different types of credit and debt—that’s the “credit mix” that makes up 10 percent of your FICO score. If you’re consolidating debt, it might be more helpful to find a personal installment loan that works for you rather than opening another credit card.